How to build a CD Ladder ?

What is a CD Ladder?

A Certificate of Deposit (CD) ladder is a strategic savings approach that allows individuals to optimize their interest earnings while still maintaining access to their funds. This method involves dividing your total savings into multiple CDs with varying maturity dates. As a result, you benefit from higher interest rates commonly associated with longer-term CDs, while still having regular access to some of your funds as they mature. This structure not only promotes better interest accumulation but also mitigates the risks associated with tying up money in long-term investments.

The fundamental principle of a CD is that it is a time deposit account offered by banks and credit unions, where individuals can deposit money for a designated period of time, usually ranging from a few months to several years. Throughout this term, the funds earn interest, which typically is higher than traditional savings accounts due to the commitment made by the depositor. The key advantage of utilizing a CD ladder is that it allows for staggered maturity dates, which means that instead of having one lump sum tied up for a long duration, you have several smaller sums that mature at different intervals.

By implementing a CD ladder, savers can take advantage of increasing interest rates over time. When each CD matures, the principal and interest earned can be reinvested into a new CD, often at a potentially higher rate. This creates a cycle that continuously maximizes interest earnings while providing opportunities for liquidity. Moreover, should an unexpected expense arise, having CDs maturing at regular intervals ensures that some of your funds are readily available without incurring penalties typically associated with early withdrawals from a standard CD. Overall, a CD ladder represents a balanced approach to saving that prioritizes growth and accessibility.

How to Build Your Own CD Ladder at Fidelity

Fidelity’s Model CD Ladders provide a quick and easy way to implement a CD ladder strategy.

Let’s say you want to purchase a CD of $25000 for 5 years. Instead, you can purchase a CD ladder.

- $5,000 in a 12-month CD with 3.50% APY*

- $5,000 in a 2-year CD with 3.55% APY*

- $5,000 in a three-year CD with 3.60% APY*

- $5,000 in a four-year CD with 3.65% APY*

- $5,000 in a five-year CD with 3.80% APY*

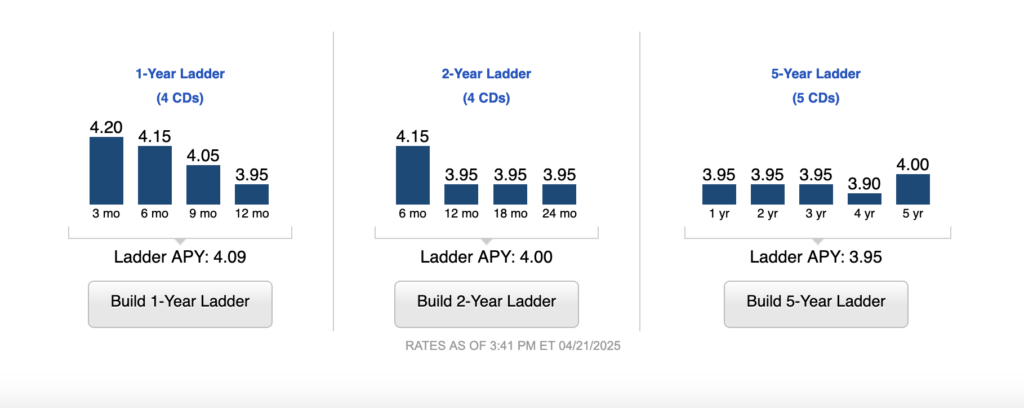

Fidelity displays three Model CD Ladders to educate investors with varying needs for liquidity and yield

or return:

A 4-step process at Fidelity

Once an investor selects a one, two, or five-year CD Ladder to build, follow these 4-step process.

Step 1 – Select an Account , Brokerage or IRA. Make sure you have sufficient balance to purchase the CD Ladder

Step 2 – Enter the total Dollar amount to invest in the Model CD Ladder. Amount will then be divided evenly across the rungs of the ladder chosen. For a 1 or 2-year Model CD Ladder, minimum investable amount is $4000.

For a 5-year Model CD Ladder, minimum investable amount is $5000.

Step 3 – Decide to participate in Auto-roll once CD matures. If you select Auto-roll, money will be re-invested.

Step 4 – Review and Buy. Fidelity will search for the highest available CD rates for each of the rung. You will see a page titled “Choose CDs” that provides a preview of the identified CDs and their quantities to be purchased. That’s it….

Things to consider….

Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or

loss. Each bank may have different terms regarding early withdrawal penalties, which can significantly impact your returns.

For the purposes of FDIC insurance coverage limits, all depository assets of the account holder at the

institution issuing the CD will generally be counted toward the aggregate limit (usually $250,000).

Disclaimer The information provided on yourmoneynest.com is for general informational purposes only. While we strive to keep the information up-to-date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will yourmoneynest.com or its owners be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.